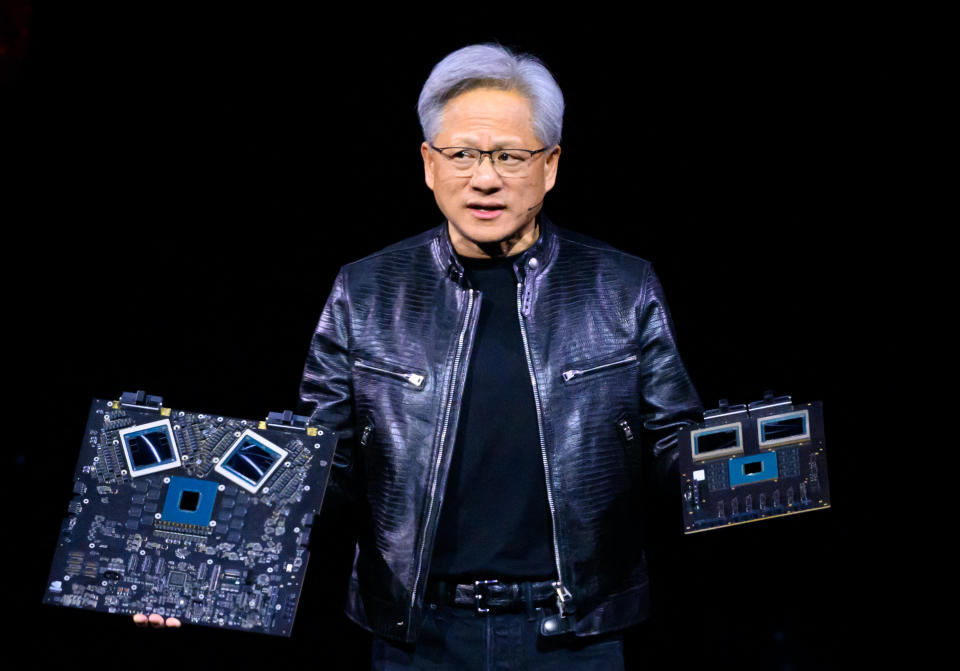

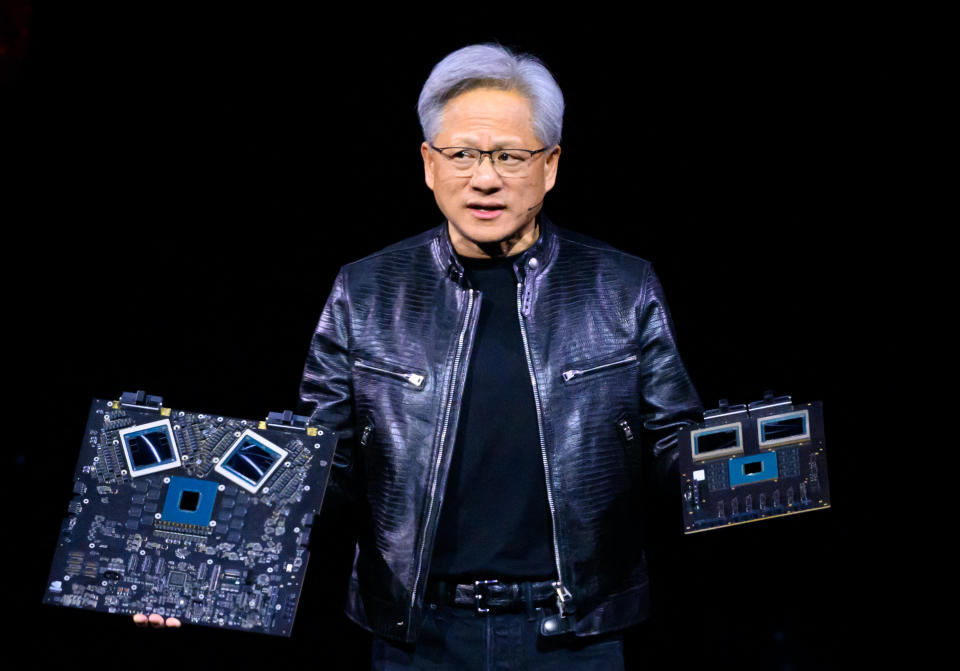

Shares of Nvidia ( NVDA ) retreated from a record high on Wednesday ahead of its first-quarter earnings report set for release after the bell. The report is expected to be one of the most important for investors this year, as Nvidia has been at the center of booming AI markets over the past 18 months.

Wall Street expects Nvidia to report revenue and profit that rose more than 200% and 400%, respectively, from the year-ago period as the company experiences a surge in demand for its chips amid the AI boom.

According to data from Bloomberg, analysts expect adjusted earnings per share to reach $5.65 on revenue of $24.69 billion. The company reported adjusted EPS of $1.09 on revenue of $7.19 billion in the same quarter last year.

Shares of Nvidia have been in decline over the past year, rising over 200% and closing at a record high on Tuesday. Shares are up nearly 700% since the stock market’s lows in October 2022. Shares were down about 0.4% in early trading on Tuesday.

The vast majority of Nvidia’s revenue will come from its Data Center business, which is expected to pull in $21 billion, up from $4.28 billion in the first quarter last year.

The company’s gaming division, once its largest segment, is expected to have revenue of $3.5 billion, up from $2.24 billion in the same quarter last year.

Ahead of Nvidia’s earnings announcement, Stifel analyst Ruben Roy raised his price target on the company’s stock to $1,085 from $910, saying he expects Nvidia to beat expectations again on its top and bottom lines. lower and will raise its guidance for the next quarter.

Demand for its chips from hyperscalers like Amazon ( AMZN ), Google ( GOOG , GOOGL ), Meta ( META ), Microsoft ( MSFT ) and others has boosted the company’s results, making Wednesday’s report a key check on appetite. of industry for further AI. investment.

And as Yahoo Finance’s Josh Schafer reported Tuesday, AI trading has moved beyond technology boundaries, with investors looking to energy and power companies as derivatives that play into the AI boom.

But Roy, like analysts at BofA Global Research and Loop Capital, says there remain near-term concerns about how much the switch from Nvidia’s current line of AI Hopper chips to its Blackwell line will affect overall sales.

The fear is that customers will put some of their orders for Hopper chips on hold while they wait for Nvidia to release its more powerful Blackwell products. On Tuesday, Amazon said it had switched an upcoming supercomputer project to Blackwell chips after a report from the Financial Times suggested the retail giant had discontinued some chip orders.

Loop Capital’s Ananda Baruah argued that it’s possible that Nvidia won’t let companies suspend their Hopper orders without losing their place in line to buy Blackwell chips. If enough customers put their orders on hold in favor of Blackwell chips, Nvidia could see a temporary drop in quarter-over-quarter sales.

Nvidia is also facing the threat of its customers building their own AI chips in-house.

So far Amazon, Google and Microsoft are using or working towards their own AI chips that offer better power efficiency than Nvidia’s offerings.

That doesn’t mean those companies will abandon Nvidia’s chips entirely, though the push for their own products could reduce the chip giant’s market share. AMD ( AMD ) and Intel ( INTC ) are gaining steam when it comes to their AI chips.

On Tuesday, Microsoft announced during its Build conference that it will begin offering AMD MI300X chips to developers looking to train and deploy AI models. The Windows maker also made sure, however, to point out that it’s also using Nvidia’s chips.

Email Daniel Howley at [email protected]. Follow him on Twitter at @DanielHowley.

Click here for the latest technology news that will affect the stock market.

Read the latest financial and business news from Yahoo Finance

#Nvidia #shares #retreat #record #high #ahead #crucial #firstquarter #earnings #report

Image Source : finance.yahoo.com