A week after Visa dropped the payments dose with a series of announcements that merged the physical and digital worlds, Google took its turn today (May 22), adding three new features to Google Pay.

According to the vice president and general manager of Google PayBen Volknew featuresare designedto address the three factors its users told the company are most important when checking out online: security, convenienceANDaccess to smart spending tools.

It starts with the end user and understanding their needs, which are unmet and will be valuable, said Volk CEO of PYMNTSKarenWebster. It’s the approach we take with everything. We spend a lot of time talking to our users, understanding them, looking at trends in the market as well.

Volk also said the new features value the creation of smart credentials over digital wallet adoption that can be used anywhere a consumer wants toto make onethe purchase. He expects them to provide flexibility and ease of use for consumers who want to visit a dealer, get in and out quickly, andto make onethe purchase.

The new features simplify the checkout process and add biometric options for users, leading to the benefits of cards at checkout. Google Pay now displays select benefits for American Express and Capital One cardholders during the checkout process on Chrome desktop. Volk said more partners are currently in negotiations. He said the feature helps users choose the card with the best rewards for their purchase, simplifying decisions about which card to use for maximum value. It helps consumers make the best decision based on what they’re buying, Volk said, again emphasizing the importance of consumers andmerchants,providing users with information about rewards at the point of purchase.

The new features simplify the checkout process and add biometric options for users, leading to the benefits of cards at checkout. Google Pay now displays select benefits for American Express and Capital One cardholders during the checkout process on Chrome desktop. Volk said more partners are currently in negotiations. He said the feature helps users choose the card with the best rewards for their purchase, simplifying decisions about which card to use for maximum value. It helps consumers make the best decision based on what they’re buying, Volk said, again emphasizing the importance of consumers andmerchants,providing users with information about rewards at the point of purchase.

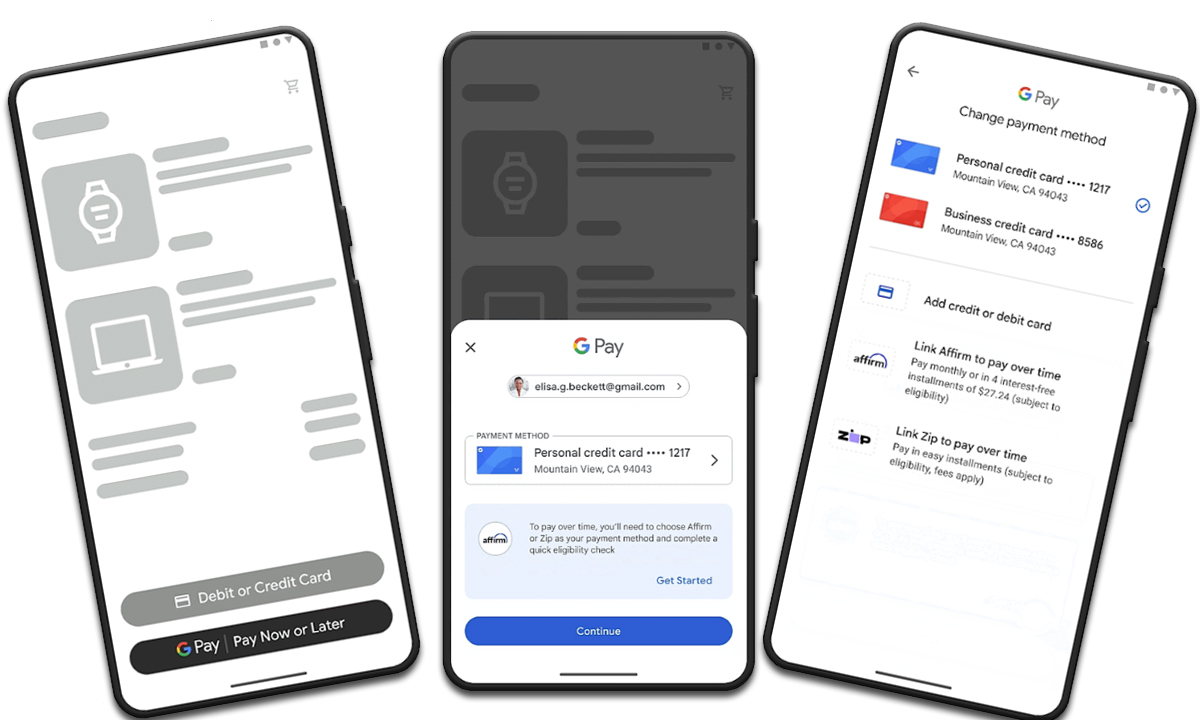

Google Pay has also expanded its Buy Now Pay Later (BNPL) options to include more merchant sites and Android apps across the US. Shoppers can link their existing BNPL accounts (currently limited to Affirm and Zip) or sign up for new ones directly through Google Pay, increasing flexibility in payment options. It’s an easy way to have that as part of the offering, giving users more options, said Volk, who came to Google last fall after a 15-year stint doing payments at Amazon. He highlighted the growing popularity of BNPL, especially among young consumers looking for flexible payment options for budgeting.

Security through biometric authentication complemented the announcement.Google Pay now allows users to fill in their card details using a fingerprint, facial scanORNEEDLE. This feature uses the device unlock method to automatically fill in full card details, reducing the need to manually enter security codes and increasing overall security. By using biometrics, we greatly increase security by removing friction for a more convenient experience, said Volk, highlighting the dual benefits of convenience and security provided by the new auto-fill feature.

According to Volk, tradersmustdo almost nothing to enable these features. The system works automatically for consumers using Chrome, requiring no additional effort from merchants during the purchase experience. He said this design aims to minimize integration challenges and reduce friction for dealers. Volk says hisThe pastthe experience helped him in his current role.

According to Volk, tradersmustdo almost nothing to enable these features. The system works automatically for consumers using Chrome, requiring no additional effort from merchants during the purchase experience. He said this design aims to minimize integration challenges and reduce friction for dealers. Volk says hisThe pastthe experience helped him in his current role.

Being a merchant in a past life gave me a deep appreciation for the amount of effort it can take to integrate new payment options and new payment methods, he told Webster. Our goal is to remove as much of that friction as possible.

AI in GPay

Volk acknowledged that while artificial intelligence (AI) doesn’t directly affect Google Pay, it has been an important part of Google’s broader strategy for a long time. He said AI and machine learning havehas been usedon various aspects of Google Pay, such as increasing security, reducing fraud and improving transaction approval rates by implementing intelligent backend solutions.

Volk emphasized that the main focus of using artificial intelligence in Google Pay is to simplify everyday purchases for consumers by making them safer and more accessible. He also mentioned that the company is constantly exploring potential future applications of AI, such as personalizing user experiences.

“One of the big changes and one of the big things that was honestly one of the reasons I came here was Google’s focus on being an ecosystem enabler,” he said. We strive to be that connective tissue between the end consumer, merchants, PSPs, financial institutions and networks. So our focus is to provide better experiences in all those aspects of the payments ecosystem. It opens the door to do many unique things, build unique products, and help others enable their products as well.

#Google #Pay #expands #BNPL #goodbye #CVV #biometrics

Image Source : www.pymnts.com